Determination of specific gravity

The physical quantity, which is the ratio of the weight of a material to the volume it occupies, is called the HC of the material.

Materials science of the 21st century has gone far ahead and technologies that were considered science fiction a hundred years ago have already been mastered. This science can offer modern industry alloys that differ from each other in qualitative parameters, but also in physical and technical properties.

To determine how a certain alloy can be used for production, it is advisable to determine the HC. All objects made with the same volume, but different types of metals were used for their production, will have different masses, it is in a clear connection with volume. That is, the ratio of volume to mass is a certain constant number characteristic of this alloy.

To calculate the density of a material, a special formula is used, which has a direct connection with the HC of the material.

By the way, the HC of cast iron, the main material for creating steel alloys, can be determined by the weight of 1 cm 3, reflected in grams. The more HC the metal, the heavier the finished product will be.

Specific gravity formula

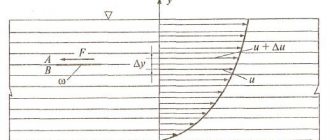

The formula for calculating HC looks like the ratio of weight to volume. To calculate hydrocarbons, it is permissible to use the calculation algorithm, which is set out in a school physics course. To do this, it is necessary to use Archimedes' law, or more precisely, the definition of the force that is buoyant. That is, a load with a certain mass and at the same time it floats on the water. In other words, it is influenced by two forces - gravity and Archimedes.

The formula for calculating the Archimedean force is as follows

F=g×V,

where g is the hydrocarbon liquid. After the substitution, the formula takes the following form: F=y×V, from here we obtain the formula for the shock load y=F/V.

Difference between weight and mass

What is the difference between weight and mass. In fact, in everyday life, it does not play any role. In fact, in the kitchen, we don't make a difference between the weight of a chicken and its mass, but there are serious differences between these terms.

This difference is clearly visible when solving problems related to the movement of bodies in interstellar space and neither those having relations with our planet, and under these conditions these terms differ significantly from each other. We can say the following, the term weight has meaning only in the zone of gravity, i.e. if a certain object is located next to a planet, star, etc. Weight can be called the force with which a body presses on the obstacle between it and the source of attraction. This force is measured in newtons. As an example, we can imagine the following picture: next to a paid education there is a stove with a certain object located on its surface. The force with which an object presses on the surface of the slab will be the weight.

Body mass is directly related to inertia. If we consider this concept in detail, we can say that mass determines the size of the gravitational field created by the body. In fact, this is one of the key characteristics of the universe. The key difference between weight and mass is this - mass does not depend on the distance between the object and the source of gravitational force.

To measure mass, many quantities are used - kilogram, pound, etc. There is an international SI system, which uses the usual kilograms, grams, etc. But besides it, many countries, for example, the British Isles, have their own system of weights and measures, where weight is measured in pounds.

Difference Between Specific Gravity and Density

UV - what is it?

Specific gravity is the ratio of the weight of matter to its volume. In the SI international system of measurements it is measured as newton per cubic meter. To solve certain problems in physics, hydrocarbons are determined as follows - how much heavier the substance being examined is than water at a temperature of 4 degrees, provided that the substance and water have equal volumes.

For the most part, this definition is used in geological and biological studies. Sometimes, the HC calculated using this method is called relative density.

What are the differences

As already noted, these two terms are often confused, but since weight directly depends on the distance between the object and the gravitational source, and mass does not depend on this, therefore the terms shock wave and density differ from each other. But it is necessary to take into account that under certain conditions mass and weight may coincide. It is almost impossible to measure HC at home. But even at the school laboratory level, such an operation is quite easy to perform. The main thing is that the laboratory is equipped with scales with deep bowls.

The item must be weighed under normal conditions. The resulting value can be designated as X1, after which the bowl with the load is placed in water. In this case, in accordance with Archimedes' law, the load will lose part of its weight. In this case, the balance beam will warp. To achieve balance, a weight must be added to the other bowl. Its value can be designated as X2. As a result of these manipulations, a shock wave will be obtained, which will be expressed as the ratio of X1 and X2. In addition to substances in the solid state, specific values can also be measured for liquids and gases. In this case, measurements can be performed under different conditions, for example, at elevated ambient temperatures or low temperatures. To obtain the required data, instruments such as a pycnometer or hydrometer are used.

Specific capital investments: who calculates them and how

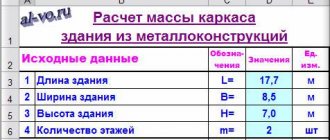

The meaning of the indicator is quite clear and simple, however, practical calculations contain a number of features. So, the formula for specific capital investments (Ukv) may look like this: Vkv = Kv/PrP, where:

- Kv - capital investments,

- PrP is the increase in production obtained as a result of these investments.

Who pays the organization’s property tax if the tenant has made capital investments in the leased property ?

Capital investments are understood as specific costs allocated to the creation of fixed assets, objects directly intended for production purposes. Here the annual indicators of investment and production growth are taken.

In addition to the increase in production, capital investments are most often calculated in relation to the increase in fixed assets.

The calculation formula may vary due to the specifics of production. Here are a few options to illustrate this idea:

- Catering enterprises that provide services traditionally use the following calculations: Vkv = Kv/M, where M is the number of seats at the catering enterprise. Capital investments per unit of power are calculated. Vkv = Kv/(V*1000), where V is the gross turnover of the commodity mass. Costs are calculated for 1 million rubles. gross trade turnover.

- In the oil industry associated with the extraction of raw materials, experts recommend calculating specific investments not only according to the increase in oil or gas production, but also as a whole indicator per one ton of extracted raw materials for fields over the entire period of operation or for a certain time period. The full amount of capital investment in the development of a particular field is taken.

- In leather production, specific capital investments are calculated per standard ton of product; Previously, all products are converted into conventional tons (of leather). Calculations are carried out similarly in the footwear industry.

- The investments associated with the production and use of the invention are usually calculated in relation to the volume of output in the year in which the costs were incurred.

Question: When can expenses in the form of capital investments incurred during the validity of the preliminary lease agreement be taken into account for income tax purposes: before the conclusion of the main agreement or after (clause 1 of Article 256, clause 1 of Article 258 of the Tax Code of the Russian Federation)? View answer

Important! Capital investments include not only the costs of fixed assets (funds), but also the associated costs of working capital.

Summarizing the information given above, we say that specific capital investments are determined not only by the increase in fixed assets and gross output for the year, but also by:

- to conditional products;

- to the total volume of production for the entire period of operation;

- to the number of workplaces of the enterprise;

- to the area of the object in construction, etc.

As we can see, the calculation results reveal the distinctive features of the indicator. Calculated by area, it is included in the cost per square meter. meters of construction site. Capital investments as a whole to the total volume of production for the entire period of operation, calculated for homogeneous objects, serve for their comparative analysis, etc.

Metals with the highest and lowest specific gravity

In addition to the concept of specific gravity used in mathematics and physics, there are also quite interesting facts, for example, about the specific gravities of metals from the periodic table. If we talk about non-ferrous metals, then the heaviest ones include gold and platinum.

These materials exceed in specific gravity such metals as silver, lead and many others. “Light” materials include magnesium with a weight lower than that of vanadium. We must not forget about radioactive materials, for example, the weight of uranium is 19.05 grams per cubic cm. That is, 1 cubic meter weighs 19 tons.

Specific gravity of other materials

It is difficult to imagine our world without many materials used in production and everyday life. For example, without iron and its compounds (steel alloys). The HC of these materials fluctuates in the range of one to two units and these are not the best results. Aluminum, for example, has low density and low specific gravity. These indicators allowed it to be used in the aviation and space industries.

Read also: Why oil does not flow to the chainsaw chain

Specific gravity of metals

Copper and its alloys have a specific gravity comparable to lead. But its compounds - brass and bronze are lighter than other materials, due to the fact that they use substances with a lower specific gravity.

Calculation example and nuances

Let the task be to evaluate the operating efficiency of two industry facilities based on specific capital investments for the same period. For the first, capital investments amounted to 3,500 thousand rubles, for the second – 4,200 thousand rubles. In the first case, 125,000 units of products were produced, in the second - 200,000 units.

Share of capital investments:

- for the first enterprise - 3500000/125000 = 28 rubles.

- for the second enterprise - 4200000/200000 = 21 rubles.

Calculations show in the second case a lower share of capital investments (21 rubles per unit of production versus 28 rubles) with a higher volume of output (200,000 versus 125,000 units). Production costs will also be lower in total, since capital investments make up a significant part of them.

In a similar way, they compare the operation of old and new equipment at one enterprise, analyze the deviation of the normative and calculated indicators of specific capital investments from the actual ones in those sectors of the economy where they are used.

Specific capital investments are calculated, as a rule, using a set of indicators characterizing the effectiveness of such costs. Additionally, the return on capital investment for the period (year) is calculated: P = Chp/Q, where:

- Chp – net profit;

- Kv – the volume of corresponding capital investments in fixed assets, the work of which gave this net profit.

The inverse indicator of profitability - payback period (C = Kv/Chp) can also be involved in analytical calculations and conclusions.

Briefly

- The calculated specific capital investments are used for economic analysis, both on their own and in combination with other indicators of the company’s performance.

- Specific capital investments are the ratio of capital costs to the increase in production made possible as a result of investments, or to the increase in fixed assets. In addition to these relationships, specific capital investments, depending on the specifics of the industry, can be calculated using other significant indicators.

- The indicator is most often used for a comparative analysis of the operation of old and new capacities at one enterprise; work of two enterprises in the same industry. In some cases, actual specific capital investments can be compared with internal corporate standards for them.

How to calculate the specific gravity of metals

How to determine hydrocarbons - this question often arises among specialists employed in heavy industry. This procedure is necessary in order to determine exactly those materials that will differ from each other in improved characteristics.

One of the key features of metal alloys is which metal is the base metal of the alloy. That is, iron, magnesium or brass, having the same volume, will have different masses.

The density of the material, which is calculated based on a given formula, is directly related to the issue under consideration. As already noted, HC is the ratio of the weight of a body to its volume; we must remember that this value can be defined as the force of gravity and the volume of a certain substance.

For metals, HC and density are determined in the same proportion. It is permissible to use another formula that allows you to calculate the HC. It looks like this: HC (density) is equal to the ratio of weight and mass, taking into account g, a constant value. We can say that the HC of a metal can be called the weight per unit volume. In order to determine the HC, it is necessary to divide the mass of dry material by its volume. In fact, this formula can be used to obtain the weight of a metal.

By the way, the concept of specific gravity is widely used in the creation of metal calculators used to calculate the parameters of rolled metal of various types and purposes.

The HC of metals is measured in qualified laboratories. In practical terms, this term is rarely used. Much more often, the concepts of light and heavy metals are used; metals with a low specific gravity are considered light, and metals with a high specific gravity are classified as heavy.

If you find an error, please select a piece of text and press Ctrl+Enter.

Specific gravity and its calculation is one of the most frequently used indicators. Its calculation is used in statistics, organizational economics, financial business analysis, economic analysis, sociology and many other disciplines. In addition, the specific gravity indicator is used when writing analytical chapters of coursework and dissertations.

Initially, specific gravity is one of the methods of statistical analysis, or rather, even one of the varieties of relative values.

The relative size of the structure is the specific gravity. Sometimes the specific gravity is called the share of the phenomenon, i.e. This is the proportion of an element in the total volume of the population. The calculation of the share of an element or specific gravity (as you like) is most often carried out as a percentage.

// Formula for calculating specific gravity

The formula itself can be presented in different interpretations, but its meaning is the same and the principle of calculation is the same.

Two important rules:

— The structure of the phenomenon should always be equal to 100%, no more, no less, if adding the fractions of 100 does not work out, then do additional rounding, and the calculations themselves are best done with hundredths.

- The structure of what you are calculating is not so important - the structure of assets, the share of income or expenses, the share of personnel by age, gender, length of service, education, the share of products, the structure of the population, the share of costs in the cost - the meaning of the calculation will be the same, divide the part by the total, multiply by 100 and get the specific gravity. Don’t be afraid of different words in the text of the problem, the calculation principle is always the same.

Example of specific gravity calculation

We check the sum of the shares ∑d = 15.56+32.22+45.56+6.67 = 100.01%, with this calculation there is a deviation from 100%, which means it is necessary to remove 0.01%. If we remove it from the 50 and older group, the adjusted share of this group will be 6.66%.

We enter the obtained data into the final calculation table

All direct problems for determining specific gravity have this calculation principle.

Complex structure -

There are situations when the source data presents a complex structure and several groupings are made within the phenomenon. The object is divided into groups, and each group, in turn, is not yet a subgroup.

In such a situation, there are two ways to calculate:

– either we calculate all groups and subgroups according to a simple scheme, divide each number by the final data;

- either we count groups from the general given, and subgroups from the value of the given group.

We use a simple structure calculation. We divide each group and subgroup by the total population. Using this method of calculation, we find out the share of each group and subgroup in the total population. When checking, you will only need to add up the groups - in this example, the urban and rural population in the total number, otherwise if you add up all the data, the sum of the shares will be 200%, and a double count will appear.

We enter the calculation data into the table

Let's calculate the share of each group in the total population and the share of each subgroup in the group. The share of urban and rural population in the total population will remain the same as in the calculation above 65.33% and 34.67%.

But the calculation of the shares of men and women will change. Now we will need to calculate the proportion of men and women in relation to the size of the urban population or rural population.

That's all. Nothing complicated or difficult.

Good luck to everyone in their calculations!

If something in the article is not clear, ask questions in the comments.

And if suddenly someone finds it difficult to solve problems, contact the group and we will help!

In the activities of any enterprise, specialists have to deal with a certain system of indicators. One of them is specific gravity. In economics, this is an indicator that reflects the weight of a particular financial phenomenon.

Example of specific gravity calculation

To better understand the process of determining the share of a company’s economic indicators, let’s look at an example based on:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. |

| Assets | ||

| Section 1: Non-current assets | ||

| NMA | 56,3 | 58,2 |

| OS | 125,63 | 125,63 |

| Long-term financial investments | 87,36 | 98,32 |

| Other noncurrent assets | 12,3 | 15,6 |

| Total for the section: | 281,59 | 297,75 |

| Section 2: Current assets | ||

| MPZ | 98,3 | 106,3 |

| VAT | 12,1 | 14,5 |

| Accounts receivable | 25,9 | 24,2 |

| Cash | 45,36 | 58,96 |

| Other current assets | 14,6 | 12,3 |

| Total for the section: | 196,26 | 216,26 |

| Total: | 477,85 | 514,01 |

| Passive | ||

| Section 3: Capital and Reserves | ||

| Authorized capital | 88,3 | 88,3 |

| Extra capital | 36,1 | 32,1 |

| Reserve capital | 55,3 | 34,2 |

| retained earnings | 56,2 | 65,3 |

| Total for the section: | 235,9 | 219,9 |

| Section 4: Long-term liabilities | ||

| Borrowed funds | 65,2 | 74,63 |

| Total for the section: | 65,2 | 74,63 |

| Section 5: Current Liabilities | ||

| Credits and loans | 96,3 | 125,69 |

| Accounts payable | 80,45 | 93,79 |

| Total for the section: | 176,45 | 219,48 |

| Total: | 477,85 | 514,01 |

Important! The income of the enterprise is reflected in the balance sheet as an asset, expenses - as a liability.

Calculation of the share of assets

First of all, let’s determine the share of current (UdVOA) and non-current assets (UdVVA) at the beginning and end of the reporting period:

UDVOA at the beginning of the reporting period = 196.26 / 477.85 * 100 = 41.07%:

UDVOA at the end of the reporting period = 216.26 / 514.01 * 100 = 42.07%;

UdVVA at the beginning of the reporting period = 281.59 / 477.85 * 100 = 58.93%;

UDVA at the end of the reporting period = 297.75 / 514.01 * 100 = 57.93%.

Now let’s find the specific weight for each asset:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. | Ud. weight at the beginning of the reporting period, in % | Ud. weight of the reporting period, in % |

| Section 1: Non-current assets | ||||

| NMA | 56,3 | 58,2 | 11,78 | 11,32 |

| OS | 125,63 | 125,63 | 26,29 | 24,38 |

| Long-term financial investments | 87,36 | 98,32 | 18,28 | 19,13 |

| Other noncurrent assets | 12,3 | 15,6 | 2,57 | 3,03 |

| Total for the section: | 281,59 | 297,75 | ||

| Section 2: Current assets | ||||

| MPZ | 98,3 | 106,3 | 20,57 | 20,68 |

| VAT | 12,1 | 14,5 | 2,53 | 2,82 |

| Accounts receivable | 25,9 | 24,2 | 5,42 | 4,71 |

| Cash | 45,36 | 58,96 | 9,49 | 11,47 |

| Other current assets | 14,6 | 12,3 | 3,05 | 2,39 |

| Total for the section: | 196,26 | 216,26 | ||

| Total: | 477,85 | 514,01 | 100 | 100 |

When calculating specific gravity, the result is often presented as a non-integer number. It must be rounded to the nearest hundredth. If after the hundredth the number is greater than 6, the last digit of the indicator is increased by 1.

General definition

They serve as micromodels of various phenomena in the financial activities of both the state in general and the business entity in particular. They are subject to various fluctuations and changes in connection with the reflection of the dynamics and contradictions of all ongoing processes; they can both approach and move away from their main purpose - assessing and measuring the essence of a particular economic phenomenon. That is why the analyst must always remember the goals and objectives of the research conducted using indicators for assessing various aspects of enterprise activity.

Among the many economic indicators compiled into a certain system, it is necessary to highlight the following:

- natural and cost, which depend on the selected meters;

- qualitative and quantitative;

- volumetric and specific.

It is the latter type of indicators that will be given special attention in this article.

Share in the economy

It is a relative and derived indicator from its volumetric counterparts. As a share, it is customary to consider output per employee, the amount of inventory in days, the level of costs per one ruble of sales, etc. Relative indicators such as structure, dynamics, plan implementation and intensity of development are also widely used.

The share in the economy is the relative share of individual elements in the sum of all its components.

The magnitude of coordination, considered as a comparison of individual structural parts of a single whole, is considered important. An example is the comparison of debt and equity capital in the passive part of the balance sheet of a business entity.

Thus, the share in the economy is an indicator that has some meaning with its significance for analysis and control. However, like any relative indicator, it is characterized by certain limitations. Therefore, the share in the economy, the calculation formula for which is contained in any thematic textbook, should be considered in conjunction with other economic parameters. It is this approach that will allow us to objectively and comprehensively conduct research into the economic activities of business entities in a certain area.

Read also: Steel rope steel grade

What does specific gravity show?

As already mentioned, specific gravity shows the influence of one part on the whole object. For example, if an indicator of production costs is calculated, it can be used to understand where the company spent more money during the production of goods.

The indicator is also used to identify output per employee, per team and per workshop. To do this, the quantity of products produced by a calculation unit (an employee, a group of specialists or a department) is divided by the total number of goods manufactured and multiplied by 100. In this case, the specific gravity reflects the quality of the work of the employee, team or workshop.

Specific gravity helps determine:

To identify the dynamics of the share in the economic development of an enterprise, it is calculated for each indicator by year. In this way, you can understand how the structure of the company's assets and liabilities has changed.

Calculation method

The answer to the question of how to find the share in the economy depends on what specific area needs to be considered. In any case, this is the ratio of a particular indicator to a general one. For example, the share of value added tax revenues in total tax revenues is calculated as the ratio of VAT payments by business entities to the total amount of revenues from all taxes. The share of tax revenues in the revenue part of the federal budget of the Russian Federation is calculated in a similar way, only tax revenues are taken directly as a private indicator, and the total amount of budget revenues for a specific period (for example, a year) is taken as a general indicator.

Calculation of the share of income

Share weight in any area is usually considered as a relationship between the particular and the whole. Accounting is no exception. Here the share of income and expenses is calculated. Each of these operations has its own specifics and features. Neglect of the recommended rules inevitably leads to calculation errors. Their consequences can vary, from tax penalties to more serious sanctions against the taxpayer.

The value of the “share” indicator in the overall assessment of the state’s economy

As mentioned above, the share in the economy characterizes its structure in various areas of activity. For example, the sectoral structure shows the degree of openness of the economy of any state. The higher the share of such basic industries as metallurgy and energy, the lower the state’s involvement in the division of labor at the international level, which characterizes the less openness of its economy as a whole.

Also, the degree of openness of the economy of any state is characterized by the share of exports in GDP (and this is also a relative indicator, represented by specific gravity). It is generally accepted that for countries with open economies the share of exports exceeds 30% of GDP, and for closed economies – up to 10%.

However, the considered share of exports in GDP is not the only indicator of the openness or closedness of the economy. Other indicators are also known. An example is the export or which are calculated by finding the ratio of the value of exports (imports) to GDP.

To summarize the above, it should be noted that the share of various indicators in the economic system is a kind of indicator of its successful functioning; based on the structure of its individual areas of activity, conclusions can be drawn about the openness or closedness of the economy. At the same time, an analysis of the structure of any economic sphere will make it possible to timely determine the factors that influence certain indicators.

FINANCIAL AND ECONOMIC ANALYSIS OF TRENDS IN CHANGES IN THE CONDITION OF RUSSIAN ENTERPRISES

Malyshkina Anna Vladimirovna 1, Rodionova Natalya Vladimirovna 1 1 Vladimir State University named after A. G. and N. G. Stoletov

Abstract

The article examines statistical data on the financial results of organizations in the Russian Federation for 1995-2012.

The data was analyzed and a forecast until 2015 was constructed. THE FINANCIAL AND ECONOMIC ANALYSIS OF THE TENDENCY OF CHANGE OF A SOLVENCY OF THE RUSSIAN ENTERPRISES

Malyshkina Anna Vladimirovna 1 , Rodionova Natalia Vladimirovna 1 1 Vladimir State University name after Aleksandr Grigorevich and Nikolay Grigorevich Stoletovs

Abstract

In clause the statistical data on financial result of organizations on Russian Federation for 1995-2012 are considered.

The analysis of the data is carried out(spent) and on them the forecast till 2015 is constructed. Bibliographic link to the article:

Malyshkina A.V., Rodionova N.V. Financial and economic analysis of trends in changes in the solvency of Russian enterprises // Economics and management of innovative technologies. 2014. No. 1 [Electronic resource]..02.2019).

In the period 1992-1998. Russia received a heavy blow to its economy, resulting in the devaluation of the ruble, a decline in production and the standard of living of the population.

Since 1995, a decline in the share of profitable organizations was noticed, and then, since 1998, a gradual growth of these organizations began (Fig. 1). In 2008, due to the economic crisis, there was a decline in the profits of Russian organizations, but not as significant as in 1998. It is worth noting that the minimum share of profitable organizations was observed in 1998. The crisis was associated with the difficult economic situation in the country, aggravated by ineffective macroeconomic policies pursued by the authorities in the mid-1990s.

Rice. 1. Dynamics of the ratio of profitable and unprofitable enterprises in the Russian economy in the period 1995-2012.

The share of unprofitable organizations has been gradually decreasing over the past 20 years. Only in 1998 the number of enterprises with losses exceeded the number of enterprises with profits.

Let's consider the amount of profit and the amount of losses of enterprises for the period 1995-2012.

Rice. 2. Dynamics of profits and losses of Russian enterprises in the period 1995-2012.

Using the trend line (Fig. 2), the forecast of changes in profits and losses of Russian organizations until 2015 was calculated using the extrapolation method (Table 1).

Table 1. – Forecast of changes in profit and loss of organizations

Production assets are considered to be all fixed assets of an enterprise that are involved in the production process and have a long useful life.

Conventionally, all fixed production assets can be divided into two parts: passive and active. The active part includes those funds that are directly involved in the production of goods or services of the company. Such an example could be: vehicles (they deliver materials, raw materials, carry out logistics, transport finished goods, etc.), production equipment (what produces goods, packages, etc.). Passive funds include everything else, namely land and buildings.

For example, you can imagine a situation where there is land, there is a building, but there is no production equipment inside, then all production does not make any sense, that is, it becomes active only if there are active fixed production assets, without them all production is in vain.

It should also be noted that production assets leave a certain structure of the company, and so, if there are more passive production assets within the structure than active ones, then such a company in the future is less effective than when active funds predominate over passive ones.

All production assets are influenced by various factors from the external environment, such factors may be:

- location of the company (territorial affiliation, proximity to transport infrastructure, urban or rural areas, good access to the plant, region, etc. are important here);

- the specifics of the product being produced (a product that is mass produced or that requires certain equipment or qualified personnel, for example, processing of precious metals or baking bread, etc.);

- level of automation of production equipment. Many industries do not have the opportunity to automate production as much as possible, even with a strong desire, since there is no such possibility (the necessary equipment is not on sale, it has not been invented or is very expensive). This factor seriously affects the efficiency of production assets.

Calculation of the share of income: economic formula

In the economic field, specific gravity illustrates the value and significance of an object. The latter can be not only income, expense, but also profit, salary, tax. Calculations are carried out using the same formula.

Calculation of the specific weight of income involves dividing the amount of a separate column by the “total” indicator and multiplying by 100. A separate column corresponds to the indicator for which the specific weight is determined. In our case, this can be any of the income received by the business structure during the reporting period (income from core activities, investments, etc.).

The specific gravity is calculated taking into account derivatives and relative indicators. The latter are the intensity of development, implementation of the plan, etc. In fact, everything depends on the goal. Specific gravity is important for analyzing indicators and monitoring their dynamics. Using the above formula, you can calculate the share of certain categories of income in different periods for subsequent comparison of data.

Features of calculating specific gravity

Specific gravity is a relative indicator. It is displayed as a percentage. It is also possible to display it in fractions. The unit of measurement is determined by the very formulation of the concept.

As for the calculations themselves, everything depends on the accuracy of the input data. Accounting errors lead to distorted results. The relative indicator may be lower or higher than the real one. Both call into question the accuracy of analytics based on the data obtained.

Who will calculate the specific gravity?

Calculating the share of income is a task for a professional accountant. Before substituting values into the formula, it would be a good idea to check the accounting status and the reliability of the data. Detected errors must be taken into account in calculations. Correcting indicators minimizes the risk of obtaining overestimated or underestimated results.

Is your accounting department overloaded with current work? Are you working with a private freelancer who cannot guarantee the accuracy of the calculations? Transfer the function to external control. Specialists from a specialized outsourcing company will perform the necessary calculation operations with a preliminary check of the accuracy of the input data. The cost of servicing the customer company will depend on the volume, complexity of the work, and the inclusion of additional options.

Calculation of the share of income is carried out promptly. The resulting indicator can be used to assess the effectiveness of the economic activities of a business entity. But we do not recommend using it as the only criterion. Specific gravity, like other relative indicators, is characterized by some limitations. Accordingly, it is rational to consider it in conjunction with other relevant economic parameters. In this case, the analysis of the subject’s activities, income dynamics and operational efficiency will be competent, complete, and as informative as possible.

Valuation of production assets

All production assets of the company are subject to evaluation and continuous accounting. In economic theory, there are 4 types of assessment of an enterprise’s production assets:

- Initial assessment of production assets. It represents the total cost that a company needs to make to purchase active and passive assets, and also includes the cost of delivery or installation of fixed assets, if required. In some cases, this amount is spent not on the purchase, but on the individual production of active funds.

- Restorative assessment of the company's production assets. This indicator represents the amount that was determined at the last assessment of all production assets of the company.

- Assessment of depreciation of the company's production assets. This assessment is made by the difference between the initial assessment of production assets and the restoration one. The amount that turns out in the end represents depreciation or is also called residual value.

- Assessing the liquidity of production assets. This assessment is made by the difference between the amount of sales of all worn-out production assets of the company and assets that are completely discontinued.

Read also: Where to install sockets in the kitchen

Types of production costs

As a rule, for analysis, not the total costs of the enterprise are used, but individual groups of costs. The following cost groups are most often used in economic analysis:

- material costs - the cost of materials, semi-finished products and raw materials purchased externally, this also includes the cost of services for their transportation, customs duties;

— energy costs cost of electricity costs;

— labor costs — wages, compensation, benefits for the main production personnel of the enterprise;

— contributions for social needs;

- depreciation of fixed assets - the amount of deductions for the restoration of fixed assets;

— other costs (for example, rent, loan payments).

Share of production assets

The share of all production assets can be in the overall structure of the enterprise's production capacity. If the share is large, then this indicates that the value of the company’s fixed assets is high, which is positive for the company in the market; if the share is small, then, accordingly, this is a more negative trend, since the level of fixed assets is decreasing.

Also within the production assets, the specific weight of active funds is allocated, which determine the economic condition of the company.

The share of active production assets is the ratio of all active assets of the company to the total value of production assets.

The more active production assets an enterprise has, the higher its competitiveness. The increase and build-up of active funds is characterized by an improvement in the equipment of the company’s technical base, which also leads to an increase in product output, and, consequently, to an increase in the income of the enterprise, and an increase in funds also contributes to an increase in the capital productivity ratio.

A high level of share falls on those enterprises where high-tech equipment is widely and deeply used, where the production process is practically automated; such enterprises are most often found in the chemical industry.

It must be said that even if enterprises are located in the same industrial sector, produce the same goods, have a similar structure of production capacities, their production assets, in terms of active assets, can differ greatly from each other.

Share of material costs in production costs

Identify the reasons for deviations from the plan and their impact on the volume of products produced and its cost

4. The share of material costs in the cost of production

,

where is the total cost of manufactured products (works, services) of the enterprise, million rubles/year.

It reflects not only the level of use of material inputs, but also the structure of production - whether its production is material-intensive or not.

5. Material input utilization rate,

where is the actual amount of material costs for the production and sale of products (works, services) of the enterprise, million rubles/year;

– the planned amount of material costs, recalculated to the actual output of products (works, services) of the enterprise, million rubles/year.

It shows how economically material resources are used in the production process: whether they are overused or not.

Particular indicators of the efficiency of using material resources and the algorithm for their calculation are given in Table. 2.

Table 2 Particular indicators of the efficiency of use of material resources

| Indicators | Algorithm | Notation in algorithms |

| 1. Raw material intensity of products, rub. | — cost of consumed raw materials and supplies, million rubles/year | |

| 2. Metal consumption of products, rub. | — cost of consumed metal, million rubles/year | |

| 3. Fuel intensity of products, rub. | — cost of consumed fuel, million rubles/year | |

| 4. Energy intensity of products, rub. | — cost of consumed energy, million rubles/year | |

| 5. Semi-finished product capacity, rub. | — cost of consumed semi-finished products and components, million rubles/year | |

| 6. Specific (private) material consumption of the product (cost), rub./piece. | — cost of all materials consumed for the i-th product, thousand rubles; — wholesale price of the i-th product, thousand rubles/piece. | |

| 7. Specific material consumption (natural or conditionally natural), kg | — the amount of material resources spent on the i product, kg/piece; — number of i-th products, pcs. |

3. Analysis of material consumption of products

During the analysis process they study:

1. implementation of the plan and dynamics of indicators of the use of material resources: determine the percentage of plan implementation, absolute and relative deviation from the plan, basic and chain growth rates and increments;

2. reasons for deviations;

3. factors causing changes in the total material consumption (material productivity) of products, and their impact on the identified deviation;

4. In-production reserves for saving material resources and developing measures for their implementation.

The economic literature recommends several methods for analyzing the material intensity of products, based on different types of factor models, in particular:

multiple: ME = MZ / TP;

multiplicative: ;

additive:

.

where is the ratio of all material costs and direct material costs;

— material intensity of products based on direct material costs, rubles;

— material consumption of products for other materials, rub.

Method 1

Let's consider a multiplicative factor model.

It shows that the indicator of the total material intensity of products is influenced by the following first-order factors:

1. Change in the ratio of all material costs and direct material costs;

2. Change in the material intensity of products based on direct material costs.

The influence of first-order factors can be calculated using various methods: chain substitutions, absolute and relative differences, logarithms and integration, etc. We use the method of absolute differences (Table 8.3).

Factors of the second and subsequent orders include factors that influence changes in the material intensity of products in terms of direct material costs.

The material intensity of products based on direct material costs can be calculated using the formulas:

(option 1);

,

(option 2),

where is the number of i-th products, pcs./year;

— specific direct costs of the j-th material resources for the production of the i-th product, thousand rubles/kg;

— level of consumption (consumption rate) of the j-th material resources for the i-th product, kg/piece;

— wholesale price of the i-th product, thousand rubles/piece;

— selling price per unit of consumption of the j-th material resources consumed by the i-th product, thousand rubles/kg;

— the share of i-th products in the total cost of their production, in shares,

=/TP,

where is the volume of the i-th and all products produced by the enterprise, respectively, million rubles/year;

— specific material consumption of the i-th product in terms of direct material resources, rubles/piece.

From the above formulas it is clear what factors influence the change in the material intensity of products in terms of direct material costs.

The influence of these factors on changes in the material intensity of products based on direct material costs can be calculated using the method of chain substitutions (Tables 3 and 4).

Table 3

Algorithm for calculating the influence of factors

changes in the total material consumption of products

Option 1

| Factor | Calculation algorithm | Notation in algorithms | |

| 1 | 2 | 3 | |

| Change in the total material consumption of products due to changes 1. Ratio of total and direct material costs | FIRST ORDER FACTORS | — material consumption of products according to direct material costs according to plan, p.; | |

| 2. Material consumption of products by direct material costs, total | actual ratio of total and direct material costs; planned and actual amount of direct material costs for the production of the enterprise's products, thousand rubles/year; — actual material consumption of products based on direct material costs, rubles; — actual volume of production in current prices, million rubles/year | ||

| Total | |||

| Changes in the material intensity of products in terms of direct material costs due to changes in 2.1. Volume of production (does not affect) | SECOND AND THIRD ORDER FACTORS | coefficient of plan fulfillment in terms of the volume of products produced by the enterprise, calculated according to the planned structure; change in the volume of products actually produced by the enterprise due to changes in its structure, million rubles/year | |

| 2.2. Structures of manufactured products | change in the material intensity of products in terms of direct material costs due to changes in the structure of manufactured products, rubles; actual number of i-th products, pcs./year; — specific direct j-th material costs for the i-th product according to the plan, thousand rubles/piece; — planned wholesale price of the i-th product, | ||

| consuming jth material resources, thousand rubles/pcs. | |||

| 2.3. Specific j-th direct material costs for the i-th product, total | change in the material intensity of products in terms of direct material costs due to changes in the specific j-th material costs for the i-th product, rub.; actual volume of products produced at comparable prices, million rubles/year | ||

| 2.3.1. Consumption level (consumption rate) of j-th material resources for i-th product, total | change in the material intensity of products in terms of direct material costs due to a change in the level of consumption of the j-th material resources for the i-th product, rub.; actual level of consumption of the j-th material resources for the i-th product, kg/piece; | ||

| planned wholesale price per unit of consumption of the j-th material resources for the i-th product, thousand rubles/kg | |||

| 2.3.2. Wholesale price per unit of consumption of the j-th material resources for the i-th product, total | ; | — change in the material intensity of products in terms of direct material costs due to a change in the wholesale price per unit of consumption of j- x material resources for ie products, p. | |

| 2.4. Selling price per unit of i-th product | |||

| Total | |||

Table 4

Algorithm for calculating the influence of factors on change

total material consumption of products

Option 2

| Factors | Calculation algorithm | Notation in algorithms |

| 1 | 2 | 3 |

| Change in the total material consumption of products due to changes 1. Ratio of total and direct material costs | FIRST ORDER FACTORS | — material consumption of products according to direct material costs according to plan, p.; |

| 2. Material consumption of products based on direct material costs | — planned and actual share of i-th products in the total cost of their production, in shares; — planned and actual specific material consumption of i-th products according to direct material costs, rubles/piece. | |

| Total | ||

| 2.1. Structures of manufactured products | SECOND AND SUBSEQUENT ORDER FACTORS | |

| 2.2. Specific material consumption of ix products, calculated using direct j-th material costs, total | change in the material intensity of products based on direct material costs due to a change in the material intensity of Ix products, calculated based on direct j-th material costs, rubles; | |

| 2.2.1. Specific direct j-th material costs for the i-th product, total | ||

| 2.2.1.1. Consumption level (consumption rate) of the j-th material costs for the i-th product, total | ||

| 2.2.1.2. Wholesale price per unit of consumption of the j-th material resources for the i-th product, total | ||

| 2.2.2. Selling price per unit of i-th product | ||

| Total |

Method 2

In accordance with this methodology, the general indicator of material intensity of products is indicated by the influence of changes in particular indicators of material intensity: raw material intensity of products (), semi-finished product intensity (), fuel intensity of products (), energy intensity of products () and material intensity of products for other material costs ().

With the additive type of factor models, the influence of factor indicators of the first level on the effective indicator is determined by direct calculation by comparing the corresponding actual indicators with their basic value (with the plan, the fact of the previous year).

Then

Each of the first-order factors is influenced by the same second- and third-order factors as the general indicator of product material intensity, considered in Method 1 (options 1 or 2).

Second-order factors according to option 1 include changes:

1. structure of manufactured products;

2. the level of corresponding material costs for individual products, characteristic of a given particular indicator of the material intensity of products (raw materials, or semi-finished products, or fuel, or energy and other material costs);

3. wholesale prices per unit of consumption of relevant material resources;

4. selling prices for products.

The methodology for analyzing the influence of second- and third-order factors (specific material intensity) on changes in the corresponding partial indicators of product material intensity is similar to that considered in option 1 or 2 with the only difference that here, when analyzing second-order factors, the following are taken into account:

not all direct material costs, but their specific types, depending on the impact of which particular indicator is assessed on the change in the general effective indicator of material intensity;

changes in prices not for all material resources, but for specific types of them.

Let's consider the methodology for analyzing second-order factors for a general indicator of material intensity of products using the example of semi-finished product capacity.

The overall change in the effective indicator of material intensity of products due to its semi-finished product capacity:

where is the planned and actual semi-finished product capacity, r.

;

,

where , - planned and actual number of i-th products, pcs./year;

— planned and actual specific semi-finished product capacity of i-th products, thousand rubles/piece;

— planned and actual quantity of j-th semi-finished products spent on the production of i-th products, pcs.;

— planned and actual selling price of the j-th semi-finished product and component used for the production of the i-th product, thousand rubles/piece;

— planned and actual selling price of the i-th product, thousand rubles/piece;

The influence of second-order factors on the change in semi-finished product capacity, and, consequently, in the material intensity of products, is calculated using the chain substitution method.

Method 3

In accordance with this methodology, the analysis of product material intensity is carried out using a multiple factor model:

where is the sum of direct (variable) and fixed material costs, thousand rubles/year.

As a result, the material intensity of products depends on the same factors as the material intensity of products for direct material costs according to method 1 (options 1 or 2), and the amount of fixed material costs. The influence of these factors on changes in the total material intensity of products is determined by the method of chain substitutions.

Then the change in the total material intensity of products (according to option 1 of method 1) due to changes:

1. Structures of manufactured products

2. Specific direct j-th material costs for the i-th product, total

2.1. Consumption level (consumption rate) of the j-th material resources for the i-th product, total

2.2.Wholesale price per unit of consumption of the j-th material resources for the i-th product, total

3. Amounts of fixed material costs

4.Wholesale price for the i-th product

LITERATURE

1. Gruzinov V.P., Gribov V.D. Enterprise Economics: Textbook. manual – M.: Finance and Statistics, 2005. – 208 p.

2. Sergeev I.V. Enterprise economy. Textbook allowance. – M.: Finance and Statistics, 2005. – 304 p.

3. Enterprise Economics / Ed. E.L.Kantora. – St. Petersburg: Peter, 2006. – 352 p.

4. Kovalev V., Volkova O Analysis of the economic activity of the enterprise. Publisher: TK Welby, 2006.

Identify the reasons for deviations from the plan and their impact on the volume of products produced and its cost

Information about the work “Analysis of the enterprise’s provision with material resources and indicators of their effectiveness”

Section: Economics Number of characters with spaces: 19549 Number of tables: 4 Number of images: 8

Similar works

Accounting for receipt of materials and analysis of the organization's provision with material resources

108205

18

2

... at the Belarusian State Economic University with a degree in Accounting, Analysis and Audit in Industry. The topic of the thesis “Accounting for the receipt of materials and analysis of the organization’s provision with material resources” and the leader are fixed by order of the rector of the university. At the same time, the topic of the thesis was carried out in agreement with OJSC Slonimmebel. In industry …

Analysis of the enterprise's provision with fixed assets and material resources; efficiency of their use

19270

0

0

... growth in labor productivity. It is desirable that the growth rate of labor productivity outpace the growth rate of technical equipment of labor. Otherwise, there is a decrease in capital productivity. Analysis of the enterprise's provision with material resources Material resources cannot be stored for future use. Analysis of an enterprise’s supply of raw materials and materials cannot be assessed by simple...

Analysis of the enterprise's supply of labor resources

84192

19

9

... from implementation. In general, it can be noted that all indicators of return on investment of the enterprise are at a high level, which indicates a fairly effective investment of the enterprise’s funds. CHAPTER 2 ANALYSIS OF THE ENTERPRISE'S AVAILABILITY WITH LABOR RESOURCES 2.1 Theoretical foundations for the analysis of the enterprise's provision with labor resources Definition of labor resources as an economic ...

Analysis of the efficiency of use of material resources at OJSC Donetsk Metallurgical Plant

70650

5

0

... rhythmicity, coefficient of variation. 2. Analysis of the use of material resources at the enterprise using the example of Donetsk Metallurgical Plant OJSC. 2.1. Analysis of the efficiency of use of material resources. Increasing the efficiency of use of material resources leads to a reduction in material costs for production, a reduction in its cost and an increase in profits. All …