Fixed means of production are a necessary component of the activities of any enterprise. The production performance of the organization depends on the condition of fixed assets and the level of their productivity. To analyze the condition of fixed assets, the depreciation coefficient is used. Today we will talk in the article about what the depreciation rate of fixed assets means, how to calculate it, what standards are established for it, and we will also tell you what analytical data can be obtained based on the depreciation rate of fixed assets.

General information on fixed assets

In the process of conducting business, all business entities use fixed assets (fixed assets). The number of fixed assets and their cost depends on the specifics of the enterprise, production volume, field of activity, etc. Read also the article: → “Depreciation of fixed assets: types, calculation features, use in management.” Fixed assets include not only equipment that is directly involved in the production process, but also:

- buildings, premises housing production workshops, offices, retail outlets, etc., that is, real estate used for the production and sale of goods, work and services;

- transport and other movable property that is used for production purposes;

- furniture, computer equipment and other property necessary to support the production process.

Fixed assets recorded on the balance sheet of an enterprise are subject to depreciation. As a result of monthly deductions, part of the cost of the equipment is written off as depreciation, so the balance sheet reflects the residual (real) value of the property based on the period of its use.

Determination of physical deterioration in real estate valuation

When making management decisions about the further use of a property, an important place is occupied by determining the degree of physical deterioration of the object in question. Indeed, a worn-out or damaged building (structure) requires additional costs to bring it into a condition suitable for further use. A completely dilapidated object may require major repairs (reconstruction) or may even be considered unsuitable for further use.

The costs of repairing (reconstructing) real estate can be very significant and in some cases their value can be comparable to the cost of the entire object, therefore a detailed and reasonable determination of the degree of physical deterioration of the object and its components is an important task that must be solved when conducting an assessment real estate.

Due to the design features of various elements of the property and due to the different effects of aggressive environmental factors leading to destructive changes, the wear of various structural systems and elements of the property occurs unevenly. In this regard, the calculation of the indicator of general physical deterioration of a real estate object (building or structure) is always carried out element by element. This means that the appraiser separately examines all structural elements of a building or structure, identifies and records existing signs of wear and tear characteristic of each structural element and determines the wear of each structural element separately.

In any real estate property, the following structural elements can be distinguished: foundation, walls, ceilings, partitions, roofs, openings, floors. Each of these elements performs its own specific function, is subjected to certain characteristic loads, has its own design features and, as a result, wears out differently. Accordingly, over time, each structural element acquires its own specific signs of physical wear.

Let us dwell in more detail on the signs of physical wear and tear of the most important of the listed structural elements of buildings and structures.

Assessment of the condition of a building or structure begins with the foundation, but not the entire foundation is accessible for visual inspection. Usually (at best) you can inspect the basement and basement of the building and, based on this, assess the degree of physical deterioration of the foundation. If the inspection does not reveal deformation of the base, cracks, destruction of the mortar in the masonry, peeling of the plaster layer, and the basement of the building is dry without signs of waterproofing damage, then we can talk about the good condition of the foundation, and the percentage of its physical wear in this case will be no more than 10%. If cracks, as well as other deformations, are noticeable in the masonry of the foundation plinth, then there is every reason to take a closer look at the condition of the entire foundation and, based on the results of this study, reliably determine the degree of its physical wear.

Another important structural element is the walls; they are the main load-bearing structures of the building. The walls can be brick, reinforced concrete, wood, etc., and signs of physical wear, accordingly, depend on the material of the walls. For example, for brick walls, the main signs of physical wear are the presence of cracks, curvature of horizontal masonry lines, deviation from the vertical, destruction of the mortar in the masonry, as well as changes in the condition of the brick material.

Another of the main structural elements of a building is the roof, which, as a rule, consists of two main elements - the supporting structure and the roof. For the supporting structure of the roof, the main signs of physical wear are deviations from the correct geometry of the lines and the condition of the construction materials, and for the roof - the presence (absence) of leaks.

It should be noted that inspecting the main structural elements and identifying visual signs of their physical wear and tear is only the first part of the work to determine the physical wear and tear of the property as a whole.

Having established the degree of wear of each structural element separately as a percentage, it is then necessary to assess the overall physical wear of the object. This can be done if the percentage contribution of the cost of each structural element to the total cost of the property is known. Such data can be found in special reference books “Enlarged indicators of replacement cost”, where all real estate objects are classified and the main indicators are given for them, including the percentage contribution of each structural element of the building (structure) to the cost of the entire object. The presence of such UPWS directories greatly facilitates the work of determining the physical wear and tear of a property.

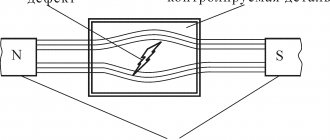

But work to determine the amount of physical deterioration of a building is not always limited to inspection and recording of visual signs of wear. There are times when a visual inspection alone is not enough. These are complex cases in which the appraiser assumes that the structure of the building (especially foundations and walls) may have hidden defects that significantly worsen the characteristics of the object and significantly affect the economic life of this object. In such cases, to accurately determine physical wear, it is necessary to carry out special technical examinations using various tools and laboratory analysis. This work is no longer performed by an appraiser, but by a specialized expert organization that has experience in such work and has the necessary equipment. In this case, an independent appraiser, when determining physical wear and tear, will rely more on the conclusions of such a technical examination than on the results of a visual inspection of the object.

In conclusion, it should be noted that determining the amount of physical wear and tear is an important and necessary stage in real estate assessment, since it helps to identify the true condition of the object, objectively determine its economic life and correctly select analogue objects for comparative analysis and assessment of the market value of the object.

© ASSESSMENT Corporation. Copying is prohibited.

How to calculate OS wear rate

To calculate the depreciation rate of fixed assets, you will need two indicators: the original cost of the property and the amount of accrued depreciation. The formula for calculating the coefficient looks like this:

CoefficientIzn = Depreciation / FirstSt * 100%,

- where Depreciation is the amount of depreciation accrued for the entire period of use of the equipment;

- FirstSt – the initial cost of the property according to accounting data.

Please note that when calculating the coefficient, the initial cost of the property is used, taking into account the improvements and modernization carried out, if any.

Example No. 1. JSC Steel Prokat has 13 machines on its balance sheet, the initial cost of which as of 02/01/17 is 10,461,360 rubles. (RUB 804,720 each). In March 2017, 2 machines out of 13 were modernized, as a result of which the cost of 2 units increased by 22,302 rubles. and amounted to 827.022 rubles. every.

The amount of depreciation accrued on the production equipment of Steel Prokata as of 04/01/17 amounted to 4,003,540 rubles. The accountant at Stal Prokata calculated the equipment wear rate as of 04/01/17:

- The initial cost of the property as of 04/01/17, taking into account the modernization carried out:

RUR 804,720 * 11 units + 827.022 rub. * 2 units = 10,505,964 rub.

- Wear rate as of 04/01/17:

4,003,540 rub. / 10,505,964 rub. * 100% = 38%.

Standard indicator value

If we talk about the standard values of the coefficient of physical wear and tear, then it does not exist in its pure form. As a rule, such coefficients are calculated for highly specialized equipment and special production facilities. Such standards are important only for technical specialists.

For the purposes of economic and financial analysis, it is enough just to know a few important patterns:

- if the indicator is more than 50%, then you should think about updating the production base;

- in companies that work in several shifts or have long working hours, the CFI will increase at a higher rate than in companies with a standard work schedule;

- the use of an accelerated depreciation mode accelerates the growth of KFI.

Important point! If the indicator grows extremely quickly, it makes sense to check the operating conditions of production facilities.

Standard wear rate indicator

Legislative acts do not provide a standard value for the wear coefficient. Each enterprise determines the standard indicator individually, its value is fixed in the provisions of the accounting policy. Practice shows that most organizations consider the value of 50% to be the limiting rate of depreciation of fixed assets. What does it mean?

Let's say an enterprise accountant has calculated the wear rate of equipment in a production workshop, the result of the calculation is a value greater than or equal to 50%. In this case, the result indicates a high degree of wear and tear on fixed assets in this group and the need for their prompt replacement. If, according to the calculation results, an indicator below the level of 50% is obtained, this indicates that, in general, the degree of equipment wear corresponds to the established norm.

In this case, it is advisable to carry out a detailed analysis of the condition of the property. For example, you can conduct a technical inspection of each piece of equipment or analyze the condition of property by groups of fixed assets. This will make it possible to obtain more specific information about the state of fixed assets in the context of their structure.

Serviceability ratio of fixed assets - what is this indicator?

Fixed assets of enterprises (depreciable) tend to wear out and lose their operational properties over time. When an object is completely worn out (when it is 100% depreciated), it is no longer used and is written off from the register. Within an enterprise, it is advisable to regularly assess the level of depreciation of property, and the depreciation coefficient (demonstrating how much the object is worn out and depreciated) and the serviceability coefficient (providing additional information about the state of the company’s assets) help in this.

Like most other financial indicators, the coefficient of serviceability of fixed assets is calculated on the basis of data from Form No. 1 - the balance sheet (to be more precise - analytical accounting cards for accounts 01 and 02).

The serviceability coefficient of fixed assets is an indicator that is equal to the ratio of the residual value* of an enterprise's fixed assets to their full original (replacement) cost.

* The initial cost refers to the original cost of fixed assets minus depreciation.

The meaning of the relationship between residual and initial value should be clarified. It is as follows. An item of fixed assets is subject to depreciation throughout its entire useful life, and this period is approved at the time the property is accepted for accounting, depending on the type of property.

According to the instructions in paragraph 4 of PBU 6/01, in general, this period is set based on how long the property in question can bring economic benefits to the owner company. Accordingly, if a fixed asset is 50% depreciated, then the reserve for the ability of this object to bring profit to the company will be only 50% of the original. That is, such an analysis demonstrates the degree of suitability of the OS. The serviceability ratio of fixed assets can be calculated:

- for a specific fixed asset item;

- for a separate group of the organization’s OS fund;

- throughout the enterprise as a whole (due to the fact that some fixed assets are not subject to depreciation (land, for example), the value of the indicator may turn out to be too high and distorted).

We invite you to read: How to return money under the DDU if you have problems with the developer

Suitability coefficient as an additional indicator of OS analysis

To obtain a complete picture of the condition and structure of the enterprise's fixed assets, along with the depreciation rate, the property suitability indicator is calculated. To do this, use the following formula:

CoeffG = RestSt / FirstSt * 100%,

- where ResSt is the residual value of the property minus accrued depreciation;

- FirstSt – the initial cost of fixed assets, taking into account the modernization and additional equipment carried out.

If the depreciation coefficient shows how depreciated the equipment is, then the fitness indicator shows the share of the residual value of fixed assets in relation to the amount of equipment according to the balance sheet (initial) accounting. Based on these coefficients, one can generally judge the technical and moral condition of fixed assets. Similar to the depreciation coefficient, the standard fitness indicator is stated in the accounting policy of the organization; its value should be no lower than 50%.

Example No. 2. JSC "Gallery" is engaged in the production of glass souvenirs. The table below provides information on the cost of fixed assets in the accounting of “Gallery” as of 02/01/17:

| Indicators | Initial cost | Amount of accrued depreciation | Residual value |

| Production workshop premises | 1.020.540,00 ₽ | 401.220,00 ₽ | 619.320,00 ₽ |

| Equipment | 410.330,00 ₽ | 100.703,00 ₽ | 309.627,00 ₽ |

| Computer technology | 308.100,00 ₽ | 201.600,00 ₽ | 106.500,00 ₽ |

| Furniture | 202.680,00 ₽ | 103.540,00 ₽ | 99.140,00 ₽ |

| TOTAL: | 1.941.650 ₽ | 807.063 ₽ | 1.134.587 ₽ |

The Gallery's accountant calculated the wear and tear rates. The calculation results were presented in the form of a statement:

| Indicators | Wear coefficient, % | Usability factor, % | ||

| Calculation | Result | Calculation | Result | |

| Production workshop premises | RUR 401,220.00 / 1,020,540.00 rub. * 100% | 39% | RUB 619,320.00 / 1,020,540.00 rub. * 100% | 61% |

| Equipment | RUR 100,703.00 / 410.330 rub. * 100% | 25% | RUR 309,627.00 / 410.330 rub. * 100% | 75% |

| Computer technology | 201.600 rub. / 308.100 rub. * 100% | 65% | RUB 106,500.00 / 308.100 rub. * 100% | 35% |

| Furniture | RUR 103,540 / 202.680 rub. * 100% | 51% | 99.140 rub. / 202.680 rub. * 100% | 49% |

| TOTAL | RUR 807,063 / 1,941,650 rub. | 42% | RUB 1,134,587 / 1,941,650 rub. | 58% |

The following standards are approved in the accounting policy of the Gallery: for the wear rate - 50% and below, for the serviceability rate - 50% and above. Based on the calculations carried out, the following conclusions can be drawn:

- the degree of deterioration of production premises corresponds to the norm;

- the technical condition of the equipment can be assessed as good (degree of wear - 25%);

- computer equipment requires prompt replacement (degree of wear - 65%);

- the state of wear and tear of furniture slightly exceeds the norm and amounts to 51%; a detailed analysis of fixed assets by subgroups is required.

The general state of wear and tear of the Gallery's fixed assets can be assessed as satisfactory (42%).

Concept and types of depreciation of fixed production assets (FPAs)

OPF are assets designed to be used in production for a long time (more than 1 year) and wear out during operation.

Wear and tear is considered to be the gradual loss of an object’s consumer qualities and, accordingly, its value. It happens in different ways. Some objects wear out due to obsolescence and dilapidation of constituent materials, mechanical wear, metal fatigue under the influence of production processes, natural phenomena and other factors, while others - due to loss of expediency of use and reduced economic efficiency in use. And since production assets wear out for completely different reasons, this phenomenon is classified according to them.

Based on the listed criteria, the types of depreciation of fixed assets include physical and moral wear and tear.

Rubric “Question and answer”

Question No. 1. Favorit JSC is engaged in the retail trade of food products, for which it uses street refrigerators and trading trays. In the retail sector, the standard value for wear and tear of street retail equipment is accepted at 45%. Can Favorit fix the value of this indicator at 50% in its accounting policy?

“Favorite” has the right to accept a wear rate of 50% or lower as the norm. However, given the specifics of the industry, the indicator will not reflect the real picture of the state of fixed assets of this group. It is advisable for “Favorite” to take into account the figure of 45% and lower as the wear rate for street trading equipment.

Question No. 2. According to the calculation results, the wear rate of computer equipment at Globus LLC is 68%. The wear rate on the Globus is set at 50% and below. Is Globus obliged in this case to urgently replace the computer equipment used at the enterprise?

The legislation does not contain direct requirements regarding the replacement of fixed assets if the depreciation rate does not meet standard indicators. However, an analysis of the wear indicator at Globus suggests that the equipment is outdated and requires urgent replacement. If Globus does not have the opportunity to replace all computer equipment with newer ones, then it is advisable to conduct an additional analysis of the equipment in the context of subgroups (computer equipment, multifunctional devices, etc.) and identify which equipment requires priority replacement and which - No.

Calculation of physical depreciation of fixed assets

This type of wear and tear manifests itself as a result of changes in various properties of fixed assets, which appear due to their use in the labor process, as well as the impact of natural and other factors on them. In an economic sense, physical wear and tear is a decrease in the original consumer value of fixed assets. It becomes the result of wear and tear, dilapidation and obsolescence. This type of wear can be determined in two ways:

1. Based on the volume of work: a comparison of the actual volume of work performed with the standard is used. This calculation method can only be used in cases where the fixed asset has a certain productivity . In other words, it can be applied to objects such as machines and machine tools. In this case, wear is calculated using the formula:

And = (Tfact x Pfact) / (Tnorm x Pnorm), where

- Tfact – time actually worked by the equipment (measured in years);

- Pfact – the average volume of products produced annually (in physical terms);

- Tnorm – standard service life of a fixed asset (in years);

- Pnorm – production capacity or productivity according to standards (in natural units).

2. According to service life. Determined by comparing the actual and standard operating time. This method is applicable to any fixed asset.