Determining the percentage of equipment wear at hazardous production facilities

It all depends on the purpose for which you determine the wear percentage. If for accounting purposes (calculating depreciation of equipment), then the method based on the time of its use according to technical documentation is legal to use. In this case, we determine the percentage of depreciation for the period from June 10, 2014 to December 31, 2015, that is, for 18.5 months.

12 months x 20 years = 240 months.

In 240 months - 100% wear. For each month - 0.42% depreciation.

0.42×18.5 = 7.7%. That is, in this case, wear is determined correctly.

But the physical (and not depreciation) wear and tear of equipment is determined by a commission based on the results of its technical inspections and surveys. They are carried out in accordance with the instructions of the operational documentation. This percentage of wear

may be higher than depreciation for a number of reasons: non-compliance with operating conditions, failure to carry out scheduled repairs, facts of incidents, accidents, etc.

Physical and moral wear and tear of fixed assets

Over time, during operation, fixed assets (hereinafter referred to as the fixed assets) wear out and lose their value.

This loss of functionality (deterioration of physical, mechanical and other properties) of the OS, expressed in a decrease in their cost, is wear and tear. Depreciation of fixed assets is calculated for the calendar year as a whole, regardless of when they were purchased, in accordance with existing standards. When the amount of depreciation approaches 100% of the original cost of the fixed assets, they are considered impaired and can be written off. At the same time, accrued 100% depreciation on operating assets suitable for use is not a basis for their write-off (liquidation).

A distinction is made between moral and physical wear and tear. The first is not directly related to the technical state of the OS, but depends on the appearance on the market of models with the best competitive advantages. As a result of the emergence of cheaper or more technically advanced analogues, the cost of operating systems is reduced until the end of their service life.

Physical wear and tear, in contrast to moral wear and tear, indicates that the operating systems in use have become dilapidated, and their constituent elements have worn out (or in some other way signs of deterioration in the original characteristics of such assets have appeared).

What is wear and tear

Wear and tear is the decrease in the value of an object during its operation or simply over time. Each asset is purchased for a specific amount, called the initial cost (IC) expressed in Russia in rubles, and is fixed at the time of commissioning or putting on the balance sheet. They also measure the amount of absolute wear.

The initial cost includes estimated commissioning and delivery costs.

Annual changes in value are subtracted from the NA, and the difference represents the real value of the object.

Determination of service life

The time during which an object retains its properties of suitability for further use is called its service life. This parameter is the most important for determining the degree of wear and is justified by the technical characteristics specified in the asset passport or other regulatory documentation.

In case of exhaustion of the service life, renewal of fixed assets is required.

What is replacement cost

The seemingly simple task of determining wear and tear is complicated by inflationary processes. The calculated price during its formal calculation may differ significantly from the market price, which necessitates revaluation and bringing it in accordance with the current situation. The result of a rather complex process, carried out taking into account many factors, is the replacement cost, which in simplified form is the real price of a similar object minus depreciation.

Types of wear

An object may lose its value for two reasons:

- Physical deterioration;

- Obsolescence.

The reasons for the first are obvious and fully correspond to the name. According to all the laws of physics, parts of technical equipment during operation are exposed to frictional forces, deformations and other factors leading to exhaustion of motor life. These destructive but inevitable processes of the reliability curve are described, which by the end of its service life falls below the permissible standard.

As for obsolescence, it is associated with the emergence of more modern means of production, which makes the operation of equipment on the balance sheet ineffective or even pointless. There are many examples.

At one time, thousands of perfectly serviceable and new (in lubricated and original packaging) mechanical adding machines became completely unnecessary after the advent of electronic calculators.

Intangible assets, for example, computer programs, deserve special mention. If their cost does not exceed one hundred thousand rubles, they can be written off “at a low price” when they become obsolete, while more expensive ones are subject to depreciation, with an acceptable minimum two-year service life.

Today, environmental and social types of wear associated with legislative changes in safety requirements and working conditions are also added to this list.

How can we calculate depreciation?

Depreciation is the process of periodically transferring the initial cost of a fixed asset or intangible asset to manufacturing, selling, or general expenses, depending on how the asset is used.

There are several methods of depreciation, but legal entities using the simplified tax system should probably choose the simplest one - the linear method of depreciation.

The straight-line method is that over the entire useful life of a fixed asset or intangible asset, it is written off in equal shares. Depreciation is charged monthly, starting from the next month after the property is put into operation, and until the original cost of the fixed asset or intangible asset is fully amortized.

As you can see from the formula, you will need to determine the original cost and useful life to calculate the monthly depreciation amount. If there are no problems with the amount of the initial cost, then determining the period of use is sometimes a difficult task.

Depreciation of fixed assets: formula

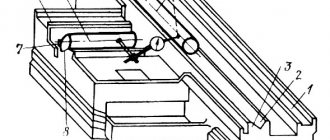

To calculate physical wear and tear (FI), 2 methods are used:

- Based on the volume of manufactured products by comparing the actual and standard service life - this method is applicable only to equipment whose productivity has been determined:

FI = (Fss × OPf) / (Nss × PM),

Fss - actual service life, measured in years;

OPF - the actual volume of production per year, in physical terms;

Nss - standard service life, in years;

PM is the installed capacity of equipment for production per year, in physical terms.

- According to the actual service life - the formula is universal and can be applied to various types of OS:

FI = Fss / Nss.

To calculate obsolescence (MI), a general formula is used, but the determination of the replacement cost of obsolete OS is different. The choice of one of them is determined by the reasons for the aging of operating systems before the end of their service life.

Consider these situations:

- If cheaper analogues appear:

MI = (PSos - VSos) / PSos,

PSOS is the initial cost of the OS;

ВСс - replacement cost of fixed assets (according to the balance sheet).

- If obsolescence is associated with the emergence of more efficient and productive operating systems, then the replacement cost of obsolete equipment (VSus) will be determined by the formula:

VSus = (VSsa × PMus) / PMsa,

ВССа — replacement cost of a modern analogue;

PMus is the production capacity of modern equipment, in physical terms;

PMSA is the production capacity of the modern analogue.

We also advise you to study the aspects of calculating depreciation - you will learn more about this in the article “Which method to choose for calculating depreciation in tax accounting?”

Wear detection

Wear, or aging, is a gradual decrease in the performance characteristics of products, components or equipment as a result of changes in their shape, size or physical and chemical properties. These changes occur gradually and accumulate during operation. There are many factors that determine the rate of aging. Negatively affects:

- friction;

- static, pulsed or periodic mechanical loads;

- temperature conditions, especially extreme ones.

The following factors slow down aging:

- Constructive decisions;

- use of modern and high-quality lubricants;

- compliance with operating conditions;

- timely maintenance, scheduled preventative repairs.

Due to a decrease in performance characteristics, the consumer cost of products also decreases.

Results

OSs that have lost their value due to wear and tear may be considered obsolete or worn out. In relation to worn-out operating systems (that have lost their original quality characteristics), it is customary to talk about physical wear and tear. Outdated (lost in price) due to the release on the market of cheaper and/or modernized and technically efficient operating systems are subject to obsolescence.

When calculating physical wear and tear, one should focus on the service life and performance of the OS; when calculating obsolescence, the replacement cost of the OS is important.

You will learn about how to manage operating systems in an enterprise from the article “Rules for managing non-current assets of an enterprise.”

We invite you to read: Citizens of which countries need patents to work in the Russian Federation

Instructions for use

For an intangible asset, the useful life is determined by the company itself. This is the period during which the intangible asset will be used and thereby generate income.

For fixed assets in accounting, an enterprise can also set the period of use independently, but it would not be amiss to coordinate this period with already developed standards and classifiers.

Therefore, to determine the useful life, we recommend using the classifier of fixed assets by depreciation groups, approved by Government Decree No. 1 of 01.01.2002.

If a fixed asset belongs to several depreciation groups, we recommend choosing a useful life from the range of the groups to which it belongs, based on the expected service life of the fixed asset.

Thus, it will be possible to obtain the monthly depreciation amount.

If it is necessary to determine the amount of depreciation for a period, for example, as of 01/01/2019, then you should first determine the date of commissioning, and then calculate how many monthly depreciation amounts should have been made. Thus, the monthly depreciation amount can be multiplied by the number of months from the date of commissioning.

Calculation example

Romashka LLC bought a passenger car for 600,000 rubles on 02/22/2016 and put it into operation on 03/10/2016.

As of 01/01/2019, it is necessary to determine the amount of depreciation for the period of use.

According to the classifier, passenger cars belong to the third depreciation group with a useful life of 3 to 5 years. We choose, for example, 5 years - the car is reliable, and we are going to use it for a long time.

The annual depreciation rate is equal to: 100% / 5 years = 20%

The annual depreciation amount is 600,000 rubles * 20% = 120,000 rubles.

The monthly depreciation amount is 120,000 rubles / 12 months. = 10,000 rub.

The fixed asset was put into operation on 03/10/2016, so until 01/01/2019 it was in operation for 9 12 12 = 33 full months.

As of January 1, 2019, the depreciation amount will be 33 months. * 10,000 rubles = 330,000 rubles.

To calculate depreciation using the straight-line method in the online calculator, you must complete two steps.

Step 1. Enter the initial cost in the left field.

This parameter is calculated at the time the equipment is accepted for accounting and represents the sum of all acquisition costs. At its original cost, the asset is accounted for in account 01. This indicator is entered into the calculator in rubles.

Step 2. Indicate the useful life in months in the right field.

In tax accounting, SPI is set in accordance with the depreciation group that includes the fixed asset.

In accounting - you can install it yourself, focusing on the specifics of the application, operating conditions, and planned service life. It is possible to assume the same useful life period in accounting as in tax accounting.

In the form of the online calculator, SPI should be entered in months.

After filling out two fields, an automatic online calculation of depreciation, as well as related parameters, is carried out.

As a result of the calculation using the calculator, you can see:

- the amount of annual depreciation charges using the linear method of writing off fixed assets;

- the amount of monthly charges;

- annual and monthly depreciation rate.

The procedure for applying the linear method.

Additional indicator - suitability coefficient

To clarify the degree of wear and tear, along with the depreciation coefficient, the serviceability coefficient of fixed assets is calculated. It does not show the degree of depreciation, but part of the residual value of the asset in relation to the original (according to accounting documents). To calculate it, you need to divide the residual value (that is, the amount minus accrued depreciation) by the original cost of the asset (if improvements were made, then taking into account the increased cost). For a percentage value, multiply the result by 100%.

Kgodn. = STost. / STperv. * 100%

The lower the depreciation rate, the better the condition of the funds. With the serviceability coefficient, the situation is the opposite - the lower it is, the shorter the effective service life of the fixed asset will be.

The determination of the normative validity of the suitability coefficient is completely similar to the wear coefficient, the only difference is in the sign: for the wear coefficient the norm is set “not higher than” a certain percentage, and for suitability – “not lower”.

General concept of wear

Depreciation of fixed assets refers to the degree to which expensive assets that belong to the organization lose their value and consumer properties. The essence of calculating the degree of wear and tear is a permanent reduction in the price of the product in accordance with the actual period of use. It should be distinguished that wear and tear as such must be accompanied by the direct exploitation of funds.

Depreciation of fixed assets

- The volume of loading of funds that are directly involved in the production process

- Features of technologies (technological process) that are used in a specific production

- The existing qualifications of the equipment operator, as well as his personal attitude towards the entrusted property

- The quality of machines or vehicles that are put into operation

- Other parameters, such as storage conditions, maintenance and care of fixed assets

Obsolescence refers not only to the obsolescence of existing facilities, but also to the degree of influence exerted by the results of the introduction of new, more progressive funds. In the latter case, the measures are more than justified, which is confirmed by the very real economic effect.

An example of such implementation is the purchase of equipment, which, unlike the old analogue, is equipped with additional functions. Typically, among such opportunities, tools are highly valued, due to which manual labor is reduced (the existing workforce is optimized).

In the practice of business entities, the concept of removable and irreparable wear is used. Removable technical deficiencies make it possible to extend the life of equipment due to restoration costs. Such actions include restoring the operational properties of gas meters, plumbing equipment or units in general.

Assessment of all types of wear - physical, functional, external

Once the full cost of reproduction has been assessed, depreciation should be deducted from the resulting amount. The term depreciation, as used in valuation, should be distinguished from depreciation in accounting.

In accounting, depreciation is the process of spreading the retrospective costs associated with acquiring an asset over its useful life, without attempting to estimate the value of the asset itself. In real estate valuation, wear and tear is considered as a factor in the current valuation, regardless of retrospective costs. Depreciation is defined as “loss of utility, and therefore value, from any cause.”

Depending on the factors reducing the value of real estate, depreciation is divided into:

1) physical wear and tear;

2) functional (moral) wear and tear;

3) external (economic) wear and tear.

Physical and functional wear and tear can be removable or irreparable. Economic wear and tear, as a rule, cannot be eliminated.

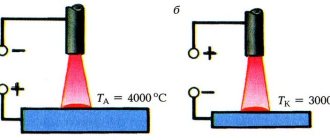

2.1. Physical deterioration reflects changes in the physical properties of a property over time (for example, defects in structural elements). Physical wear and tear can occur under the influence of operational factors or under the influence of natural and natural factors. Depreciation is considered irreparable when the cost of correcting the defect exceeds the cost that will be added. Reversible wear assumes that the cost of correction is less than the added value.

There are four main methods for calculating physical depreciation:

- expert;

- regulatory (or accounting);

- cost;

- method for calculating the life of a building.

The most accurate and most labor-intensive method is the expert method (using the defect list https://www.npoekt.ru/repair-list-building.html). It involves creating a defective list and determining the percentage of wear of all structural elements of a building or structure.

Example.

The table determines the wear of individual structural elements of the building using the expert method.

The standard method for calculating physical wear and tear is based on the use of various regulatory instructions at the interindustry or departmental level. It is used extremely rarely in valuation practice.

The cost method is to determine the costs of restoring elements of buildings and structures. Through inspection, the percentage of wear and tear of each element of the building is determined, which is then translated into value terms. The cost method is used to determine removable physical wear and tear. A conditional example of calculating physical depreciation using the cost method is given in Table.

This method allows you to immediately calculate the wear and tear of elements and the building as a whole in cost terms. Since the impairment calculation is based on reasonable actual costs of bringing worn-out items to almost new condition, the result of this approach can be considered fairly accurate. The disadvantages of the method are the required detail and accuracy in calculating the costs of repairing worn-out building elements.

Calculation of wear and tear using the life cycle method . Cumulative accumulated wear is a function of the age of the object.

When calculating wear using the effective age method, the following concepts are used:

- physical life of the building,

- effective age,

- remaining economic life.

Let's consider the periods of a building's life and the evaluation indicators characterizing them (see figure)

The physical life of a building (PL) is the period of operation of a building during which the condition of the load-bearing structural elements of the building meets certain criteria (structural reliability, physical durability, etc.). The physical life of an object is laid down during construction and depends on the capital group of the building. Physical life ends when the object is demolished.

Chronological age (CA) is the period of time that has passed from the commissioning of an object to the date of assessment.

Economic life (EL) is determined by the operating time during which the object generates income. During this period, improvements made contribute to the value of the property.

Effective age (EA) is calculated based on the chronological age of the building, taking into account its technical condition and the economic factors prevailing on the date of assessment that affect the value of the assessed object. Depending on the operating characteristics of the building, the effective age may differ from the chronological age up or down. In the case of normal (typical) operation of a building, the effective age is usually equal to the chronological age.

The remaining economic life (REL) of a building is the period of time from the date of assessment to the end of its economic life (Fig.).

Determining the depreciation of buildings using the life-span method is based on an examination of the structures of the object being assessed and the assumption that the effective age of the object is related to the typical economic life span as accumulated depreciation is to the cost of reproduction (replacement) of the building.

Indicators of physical wear and tear, effective age and economic life span are in a certain ratio, which can be expressed by the formula

I = (EV: VF) • 100% = [EV: (EV + OSFJ)] • 100%,

where I is wear, %;

EV – effective age, determined by an expert based on the technical condition of the elements or the building as a whole;

VF – typical period of physical life;

RSF – remaining period of physical life.

Physical depreciation can be calculated both for individual elements of the building with subsequent summation of the calculated depreciation, and for the building as a whole. For approximate wear calculations, it is possible to use a simplified formula

I = (HV: VF) • 100%, (6.5)

where I is wear, %; VF is a typical period of physical life.

The use of the formula is also relevant when calculating percentage adjustments for wear and tear in compared objects (comparative sales method), when it is not possible for the appraiser to inspect selected analogues to determine the indicators used in the formula.

The percentage of depreciation of elements or the building as a whole calculated in this way can be translated into monetary terms (depreciation):

O = SV • (I: 100),

where I is wear, %;

SV – cost of reproduction (replacement cost).

Example.

A large industrial property complex is subject to assessment. The assessment date was April 1, 2005. Let's consider the calculation of wear and tear for several warehouses from a given property complex, built in accordance with the same project, used for storing building materials. In accordance with the documentation for the warehouses being assessed, the physical life span is 75 years (FL = 75 years).

The effective age is determined by the appraiser in accordance with the technical condition of the objects being assessed; the data for calculating wear and tear are given in the table.

This method of calculating depreciation is applicable for mass valuation, when valuing real estate objects as part of the assets of an enterprise when valuing an enterprise (business).

The disadvantage of using the lifespan method to estimate accumulated wear and tear is that there is only one factor that determines the amount of wear and tear (the ratio of effective age to physical life). To eliminate this drawback, various types of cost reduction factors are considered and a method of dividing into types of wear is used.

2.2. Functional wear and tear means that something in the object being assessed does not correspond to the spirit of the times. The property being assessed may still function perfectly, but may not meet modern standards. A defect may be remediable or irreparable, depending on how the cost of correcting it compares with the benefits expected from it. Fatal depreciation is usually measured as a loss in the annuity amount.

The amount of removable wear and tear is determined as the difference between the potential value of the building at the time of its assessment with updated elements and its value at the date of assessment without updated elements (the difference between the cost of reproduction of the building and its replacement cost).

Causes of functional wear:

- deficiencies requiring addition of elements;

- deficiencies requiring replacement or modernization of elements;

- super improvements.

Deficiencies requiring addition - elements of the building and equipment that do not exist in the existing environment and without which it cannot meet modern performance standards. Depreciation due to these items is measured by the cost of adding these items, including their installation. Functional wear can be removable or irreparable. Removable functional wear is most often calculated using the cost method.

Disadvantages that require replacement or modernization of elements - items that still perform their functions, but no longer meet modern standards (water and gas meters and fire-fighting equipment). Depreciation for these items is measured as the cost of existing elements, taking into account their physical deterioration, minus the cost of returning materials, plus the cost of dismantling existing ones and plus the cost of installing new elements. The cost of returning materials is calculated as the cost of dismantled materials and equipment when used at other facilities (revisable residual value).

Superimprovements are positions and elements of a structure, the availability of which is currently inadequate to modern requirements of market standards. Removable functional wear in this case is measured as the cost of reproducing super-improved items minus physical wear, plus the cost of dismantling and minus the salvage value of the dismantled elements.

An example of over-improvement is a situation where the owner of a house, adapting it for himself, made some changes for his own convenience (investment value), which were inadequate from the point of view of a typical user. These include the redevelopment of the usable area of premises for a specific use, determined by the owner’s hobbies or his occupation. Removable functional wear in such a situation is determined by the current cost of bringing the changed elements to their original state.

In addition, the concept of over-improvement is closely related to the segment of the real estate market, where the same improvements can be considered both appropriate for a specific segment and excessive from the point of view of the typical user.

Example of calculating functional removable wear

Irremovable functional wear and tear is caused by outdated space-planning and/or structural characteristics of the buildings being assessed relative to modern construction standards. A sign of irreparable functional wear and tear is the economic inexpediency of spending on eliminating these shortcomings. In addition, it is necessary to take into account the market conditions prevailing at the date of the assessment to ensure that the building is adequately architecturally suited to its purpose.

Depending on the specific situation, the cost of irreparable functional wear and tear can be determined in two ways:

- capitalization of rental losses;

- capitalization of excess operating costs.

To determine the necessary calculation indicators (rental rates, capitalization rates, etc.), adjusted data for comparable analogues are used.

| In this case, the selected analogues should not have signs of irreparable functional wear identified in the object being assessed. In addition, the total income generated by the property complex as a whole (building and land) and expressed in rent must be divided accordingly into two components. To allocate part of the income attributable to the building, you can use the investment balance method for the building or the method of analyzing the ratio of the value of the land plot and the total sales price of the property complex. In the example, the specified procedure is considered to be completed during the preliminary calculations |

| Determination of impairment caused by irreparable functional wear and tear due to an outdated space-planning solution (specific area, cubic capacity) is carried out by the method of capitalizing losses in rent. Calculation of irreparable functional wear and tear by capitalizing the excess operating costs required to maintain the building in good condition can be done in a similar way. This approach is preferable for assessing the irreparable functional wear and tear of buildings that are distinguished by non-standard architectural solutions and in which, nevertheless, the amount of rent is comparable to the rent for modern analogue facilities, in contrast to the amount of operating costs. |

2.3. External wear and tear is caused by factors external to the property (economic, environmental, political, etc.). Such factors could be congested streets or an industrial plant located near a residential area.

External deterioration is always considered irreparable because the magnitude of the potential costs makes it unsustainable to purchase surrounding properties and remove associated detrimental elements just to increase the cost of one affected item.

External depreciation (also called economic, locational, or environmental depreciation) is measured by the capitalized value of rental losses assessed using the gross rental multiplier.

Example:

It is required to determine the residual replacement cost of an office building.

Initial data:

– building area – 3000 m2

– the building was built 15 years ago;

– expected lifespan – 60 years;

– the practice of construction organizations shows that the unit costs for the construction of such a new building are $250 per 1 m2

Solution:

a) The costs of constructing a new similar building are equal

3000m2 × $250 per m2 = $750,000

b) Physical wear and tear is equal to:

15/60 * $750 000 = $187000

The appraiser did not find any other types of wear.

c) The residual replacement cost of the office building is:

$750 000 – $187 500 = $562 500.

External (economic) depreciation is the depreciation of an object due to the negative influence of the external environment in relation to the object of assessment: location, market situation, easements imposed on a certain use of real estate, changes in the surrounding infrastructure and legislative decisions in the field of taxation, etc. Although external wear cannot be eliminated in most cases, it can sometimes resolve itself due to a positive change in the surrounding market environment.

The following methods can be used to assess external wear:

- method of capitalization of rental losses;

- method of capitalizing excess operating costs;

- paired sales method;

- lifetime method.

The assessment of external wear and tear by the method of capitalization of losses in rent and the method of capitalization of excess operating losses is carried out similarly to the calculation by these methods of functional wear and tear discussed above. When assessing external wear and tear, it is necessary to identify losses in rent caused by signs of external wear and tear or excess operating costs caused by signs of external wear and tear.

The paired sales method is based on the analysis of available price information on recently sold similar properties (paired sales). It is assumed that the objects of paired sale differ from each other only by the economic depreciation identified and related to the object of assessment. A similar approach to calculating external wear is shown in table.

| Example. It is necessary to assess external wear and tear caused by a decrease in the investment attractiveness of an office building due to the establishment of a clothing or food market in its immediate vicinity. Let a pair sale of objects A and B of a similar purpose be identified on the real estate market. The cost of land in this area is 30% of the total cost of a typical property. |

The life-of-life method calculates fatal external deterioration based on the sharp reduction in the remaining economic (physical) life of the building due to its demolition in the near future.

Reasons for demolition:

- the need for redevelopment;

- expansion of transport routes.

The technical condition of the buildings being demolished should be taken into account, which in many cases would allow them to be used for a fairly long period of time.

Example. The subject to assessment is a building that was previously removed from the housing stock and is now adapted for administrative needs. The building is in municipal ownership. The physical deterioration of the assessed building, according to the BTI, at the time of assessment is 40%. The technical condition of the building, location and developed infrastructure indicate a fairly high commercial attractiveness of the property from potential investors. However, according to the redevelopment plan, for the reasons stated above, the building is subject to demolition after five years from the date of assessment.

During the inspection of the object by an expert, the following indicators were determined:

1) the effective age of the building being assessed is 30 years;

2) the remaining economic life is 60 years.

Percentage of accumulated wear excluding activity. external factor is calculated by the formula:

I = EV: (EV+OSEJ)100 = (30:90) • 100 = 33%.

Percentage of wear taking into account the action of external factors:

I= (30 / 35) • 100 = 86%.

| The accumulated wear of 86% calculated in this case is due to the action of predominantly external factors. The share of possible consideration of other types of wear in this result is extremely small, which allows us to consider the result obtained as external wear. A sharp reduction in the remaining economic life of a building leads to a decrease in investment attractiveness and, as a consequence, a precipitous drop in the probable sale price. In such cases, the purpose of the valuation is not to calculate the full ownership of the building being valued, but the short-term lease rights for the remaining economic (physical) life, provided that the potential investor sees any benefit from this acquisition. |

The technical condition of the buildings being demolished should be taken into account, which in many cases would allow them to be used for a fairly long period of time.

Depreciation can be determined by an indirect (market) or direct method.

With the indirect method, the assessment of the amount of depreciation is carried out by subtracting the value obtained as a result of applying the market or income method (or both together) from the sum of the total cost of reproduction of the building and the cost of the land. The resulting difference is the total accumulated wear. For example, if the sum of the total reproduction cost and the market value of an object is $750,000, and the market and income approaches showed a value of $500,000, then $250,000 is accumulated depreciation. The disadvantage of this method is that it does not allow for an independent assessment of wear and tear within the most expensive approach.

The direct method is to estimate each type of depreciation for each component of the property being valued.

How to calculate deductions for fixed assets online?

The linear method is used in both accounting and tax accounting. It is characterized by a uniform write-off of the cost of the operating system during the entire service period.

To calculate depreciation using the straight-line method, you should indicate your choice in your accounting policy. For accounting purposes, the method must be applied to a group of homogeneous assets, for tax purposes - for all existing fixed assets.

We invite you to read: It is in the process of liquidation, what does it mean?

In order for the calculator to calculate depreciation charges online, you just need to fill out two fields in the form.

How to calculate the amount of depreciation

In order to calculate the decrease in the consumer properties of an object, several methods are used. All of them are generally accepted, but the choice of a particular one can be based solely on the economic benefit pursued by the enterprise.

Calculation methods

The method is really simple, since it can be used without special accounting knowledge. The initial parameters for calculation are the cost of acquiring the object (price of commissioning) and useful life. To determine the values of objects that have already been in use, data is usually requested from the seller.

For example, an enterprise purchased new machines, the cost of which is 200,000 rubles. The period for maintaining performance characteristics determined by the manufacturer is 10 years. The value of annual depreciation in this case will be 10% of the cost of the equipment or 20,000 rubles. Thus, after two years of operation of one machine, its residual value according to accounting will be 160,000 rubles.

An alternative option for calculating depreciation parameters is the option of determining the balance that should be obtained at the end of the period under consideration. The reducing balance is calculated based on parameters such as the initial (residual) value of the object, the calculated depreciation rate and the so-called acceleration value. The last parameter increases the approach of the end of the useful life by increasing the depreciation rate.

For example: an enterprise purchased machines at a price of 200,000 rubles. They should be written off after 10 years, but in accordance with the Government Decree, an acceleration factor of 2 is applied to this group of equipment. Accordingly, the depreciation rate for such fixed assets will no longer be 10, but 20%. In other words, federal executive authorities can adjust the useful life of equipment recommended by the manufacturer.

Wear calculation

The second method, from the point of view of economic benefits from the cost of purchasing equipment, is more correct. The algorithm involves accrual of depreciation depending on how many units of product were produced on such a machine. The method is also preferable for cases when the enterprise has vehicles on its balance sheet.

Example: an enterprise purchased a Gazelle car. The established mileage for vehicles is 400,000 km. The cost of the car at the time of registration was 900,000 rubles. Accordingly, if in the current period (month, quarter) a mileage of 50,000 km is recorded, then depreciation will be equal to 400,000 / 50,000 * 900,000 = 7,200 rubles.

How to identify obsolescence

To determine whether it is advisable to continue using an obsolete fixed asset, certain formalities must be observed. The manager must create a commission, which includes the chief accountant and persons who are responsible for the safety of fixed assets (clause 77 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The commission determines how obsolete the fixed asset is, determines whether individual parts of the object can be used after write-off, and draws up a write-off act in form No. OS-4, or No. OS-4a (in relation to motor vehicles), or No. OS-4b (in regarding groups of objects).

How to calculate equipment wear

As already mentioned above, wear and tear of machines, cars and other equipment means a decrease in its consumer properties in value terms. The reasons for the decrease in balance sheet values are quite clear: this is the obsolescence of fixed assets and their physical wear and tear. Often, due to crisis phenomena, the cost of equipment can be recalculated several times downward. This is especially true for those machines that vendor companies sell in dollar terms.

Be that as it may, the desire for timely accounting for subsequent depreciation is not always the main goal of business organizers. The use of the latest technologies makes it possible to carry out restoration work, as a result of which some of the effects of wear can be eliminated.

The most difficult part of accounting calculations is the recovery of accounting data. So, if the accounting department does not have the necessary information, an integrated approach will be necessary:

- Inspection of equipment.

The unit is started, the performance of basic functions and production time are checked. Further, the equipment is classified according to databases (for example, you can view the data on the nameplate), as well as the profile of the processes being executed. Depreciation of equipment - At the next stage, it is necessary to find out whether changes were made to the design of the equipment, whether modernization, replacement of parts and service were carried out. The situation may be complicated by the fact that some responsible persons do not consider it necessary to reflect such changes in the product data sheet or technical documentation. In addition, the use of these documents does not always provide reliable information. To clarify the presence of design changes and other manipulations with the technical device of the machine, a method is used to compare temporary data corresponding to the period of major repairs and changes in design.

- It is determined what place the unit occupies in the production cycle. For this purpose, an additional classification of the unit is carried out for inclusion in the group of auxiliary or leading production tools. Assignment to the last category occurs on the basis of the issuing link. That is, if the machine directly manufactures products, it is the last in the chain, it is the main equipment.

- At this stage, the degree of physical wear and tear of units, equipment or vehicles is calculated. It is necessary to develop a system of indicators and, on its basis, characterize the capabilities of the equipment in question. Experts are often involved in such calculations; they use mathematical methods in their work. Most often, to determine the degree of wear, similar equipment that is in operation, in the production cycle, is used. If such equipment is not available in the region, a request is submitted to the vendor - an organization that acts as the official distributor of the manufacturing plant.

We suggest you read: Where to check the seizure of property

Conventional wear coefficient

The value of this indicator is used for analytical accounting, and does not reflect the actual state of a particular fund. An asset that is not actually completely worn out may have a zero residual value. The reason for the conditionality is the dependence of the wear coefficient on the chosen method for determining depreciation charges. Thus, it shows not how much fixed assets are worn out, but to what extent they are depreciated.

IMPORTANT! If you need to evaluate the depreciation rate more objectively than simply taking into account depreciation, it must be compared with the corresponding data for the industry or correlated with similar data for this group of fixed assets from partners or competitors.

The depreciation rate of fixed assets can be calculated in relation to:

- physical depreciation of fixed assets;

- obsolescence of tools, equipment, etc.;

- the ratio of the residual value of funds and their market price.

How is car depreciation calculated?

As a result of a traffic accident, a car inevitably loses its appearance and market value. On the one hand, the car owner does not need to take special measures to assess the extent of damage. For repairs they will charge him as much as necessary. In this case, replacement of parts, as a rule, occurs with new analogues or used ones with the consent of the owner.

The need to carry out calculations to assess the degree of wear and tear arises when a person applies for an insurance premium to his insurer. According to the current agreement, the person will be compensated for the cost of restoration work and the price of spare parts, taking into account wear and tear. If in the first case a citizen can count on the application of current prices, then in the second case a large number of disputes almost always arise.

Car wear and tear

Since 2010, a document has been in force in the Russian Federation, the provisions of which are addressed by experts from independent agencies, representatives of insurance companies and vehicle owners themselves. Calculation of material damage in accordance with the Government Decree involves determining the fair value of spare parts, taking into account their depreciation.

Each side of the conflict may interpret this document differently, but the fact remains: citizens use it to compare their losses. The calculation formulas are quite complex, but in any case they help clarify the situation. A special group includes spare parts for a car, which have a direct impact on safe driving.

For example, for wear and tear of a vehicle body, parameters such as age and the manufacturer’s warranty against through corrosion are used. To calculate the depreciation of a machine tire, the following initial data are taken: the height of the pattern of the new product and the actual height, the parameter of the minimum permissible height. An additional factor that corrects the degree of wear is the age factor.

Studying trends in establishing wear indicators, it is noted that underestimation of coefficients occurs for the best-selling car brands in Russia. According to calculated data, the average depreciation of a domestic car is 5-6% per year. It turns out that after 20 years there is no particular point in taking out insurance, since the insurance company will only pay for repairs, but not for parts.

Still, calculating wear and tear is best left to experts. Experts take into account three stages in which a part becomes obsolete. The first is the running-in of adjacent parts as a result of friction. The second stage is considered the normal period of operation. The third period is considered the time of critical (complete) wear and tear, at which the car or its individual component becomes unsafe.

List of documentation required to assess physical wear and tear

To carry out assessment activities, the following list of documentation may be required:

- Original document identifying the owner of tangible assets.

- Technical passports of objects, accompanying documentation from manufacturers, other documents containing data on the initial characteristics of the equipment.

- Inventory cards of assessment objects.

- Documents providing information about ongoing repairs and maintenance.

- Papers with information about assessments carried out previously.

The presented documents, in particular information from them, will provide the most reliable information about the level of wear. Based on the results of the inspection, the customer will be provided with a report containing complete information regarding wear, as well as recommendations from an expert.

Applying to New Horizons for an independent assessment of the physical wear and tear of equipment is a guarantee of your profitable deals!

Federal Law “On Valuation Activities in the Russian Federation” (No. 135-FZ)

Federal Law “On State Cadastral Valuation” (No. 237-FZ) dated 07/03/2016

Federal assessment standard “General concepts of assessment, approaches to assessment and requirements for assessment” (FSO No. 1)

Federal Valuation Standard “Purpose of Valuation and Types of Value” (FSO No. 2)

Federal assessment standard “Requirements for an assessment report” (FSO No. 3)